Dive Brief:

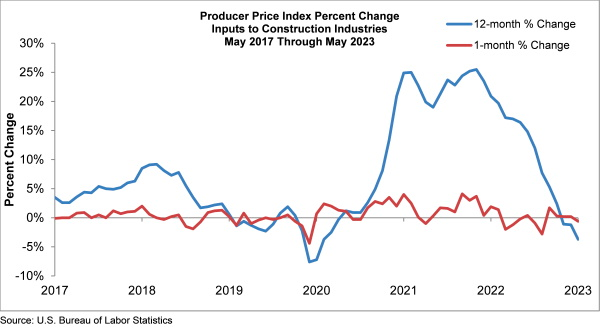

- Construction input prices posted a 0.6% decline in May, marking the third consecutive month of reduced costs, while nonresidential construction input prices dropped 0.5%, according to new Associated Builders and Contractors analysis.

- Construction input prices are now 3.7% lower than a year ago and are continuing to fall. However, much of that drop is tied to energy, steel and softwood lumber, said Anirban Basu, ABC chief economist.

- “Beyond those spheres, there is plenty of input price inflation,” said Basu. “With so many public and private megaprojects under development in the United States, it is likely that many input price categories will continue to show inflationary tendencies even if the overall economy dips into recession.”

Dive Insight:

Despite the positive news of cost declines, Basu warned that many key construction materials continue to get more expensive.

That’s largely because multi-billion dollar megaprojects continue to break ground across the country, causing upward pressure on key construction materials. For instance, a couple massive manufacturing projects to break ground over the past two months include a $5.5 billion Hyundai EV plant in Ellabell, Georgia, and a $1.2 billion Hanwha Qcells solar manufacturing plant in Cartersville, Georgia.

Concrete prices moved up 1.1% in May and jumped 12.4% for the year. The price of construction machinery and equipment rose marginally for the month but remains up more 9.1% over the past year. Additionally, brick and structural clay tile prices, as well as adhesives and sealants, also increased more than 9% over the past 12 months.

Further, steel mill products jumped 5.2% in May, following a 3.6% rise in April, while the rise in concrete products prices was the 30th consecutive monthly increase.

But despite widespread supply chain challenges, a weakening global economy has in fact placed downward pressure on several traded commodities, said Basu.

For instance, unprocessed energy materials moved 43.2% lower in May, softwood lumber tumbled 40.4% and crude petroleum prices dropped 30.8% for the month, according to the report.

Much-needed relief

The drop in certain materials prices means contractors are finally experiencing relief from recent supply chain problems and lingering price escalations, said Ken Simonson, chief economist at the Associated General Contractors of America, in an AGC report on materials costs released Wednesday. But over the longer term, those costs are still significantly higher than three years ago.

For instance, inputs to construction remain elevated 38.2% since the start of the pandemic in February 2020. Meanwhile, inputs to nonresidential construction are still 39% higher.

Similar to Basu’s warning, Simonson cautioned that some key materials remain very hard to find.

“There are still exceptionally long lead times for electrical equipment and renewed or persistent price increases for steel and concrete,” said Simonson.

Stephen Sandherr, AGC’s CEO, questioned whether domestic Buy America supplier mandates could lead to future price escalations.

“All of us want more domestic manufacturing, but the reality is that it will take years — if ever — before the products those factories make will be entirely sourced within the U.S.,” Sandherr said in the release.