Dive Brief:

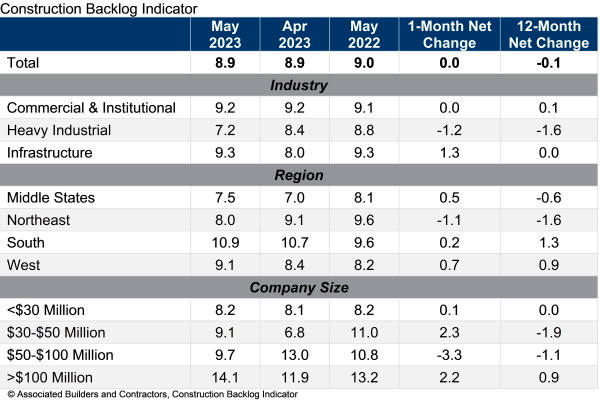

- Construction backlog held steady at 8.9 months in May as increased infrastructure bookings offset a plunge in heavy industrial projects, according to Associated Builders and Contractor analysis.

- Commercial and institutional backlog was unchanged at 9.2 months, but heavy industrial projects plunged by 1.2 months, or about 14%. A 1.3-month uptick in the infrastructure segment – a 16% gain – offset that loss to hold overall levels basically flat over the last 30 days and year.

- “During a period of ongoing tumult associated with major bank failures, a near-miss debt ceiling and shifting monetary policy, nonresidential construction backlog has remained remarkably stable,” said Anirban Basu, ABC chief economist in the release. “At nearly nine months, backlog is essentially unchanged from a year ago and the previous month.”

Dive Insight:

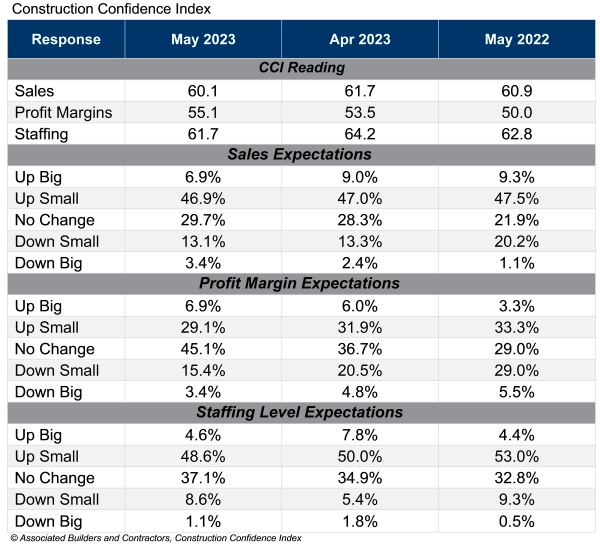

ABC’s Construction Confidence Index reading for sales and staffing levels both moved lower in May, but stayed well above a score of 50, indicating expectations for continued growth over the next six months, according to ABC. But its reading for profit margin expectations ticked up again, defying the impacts of inflation and higher wages.

“Contractor confidence remains elevated despite massive increases in cost of capital and growing concerns over the nation’s commercial real estate segment, with firms indicating sufficient demand and associated pricing power that will keep profit margins steady or better,” said Basu. “Contractors also expect to bring on additional talent over the next six months, an indication of ongoing industry expansion.”

While infrastructure projects, led by the manufacturing boom, moved up in May, commercial and institutional projects stayed flat. The sector hasn’t experienced much growth over the past few months, especially as credit conditions tighten, material prices rise and inflation persists, according to the report.

The latest Dodge Momentum Index, a benchmark that measures nonresidential planning, dropped 2% in May due to slower commercial activity. The index, which typically leads actual construction spending by 12 months, fell for the third month in a row and could indicate further slowdowns for the rest of the year.

ABC’s backlog reading measures the work that contractors have booked, but have not yet begun. The association pairs the benchmark each month with its Construction Confidence Index, which polls construction executives about their outlook for sales, profit margins and staffing over the next six months.